Why Mutual Funds Are the Smartest Investment for Retail Investors?

We have all dreamt of owning a bigger house, driving a flashier car, or vacationing in an exotic location. There is nothing wrong with these aspirations—after all, it is human nature to strive for more. People should always have enough and more. However, as we go through life, it eventually becomes apparent that our once-handsome salary is no longer enough.

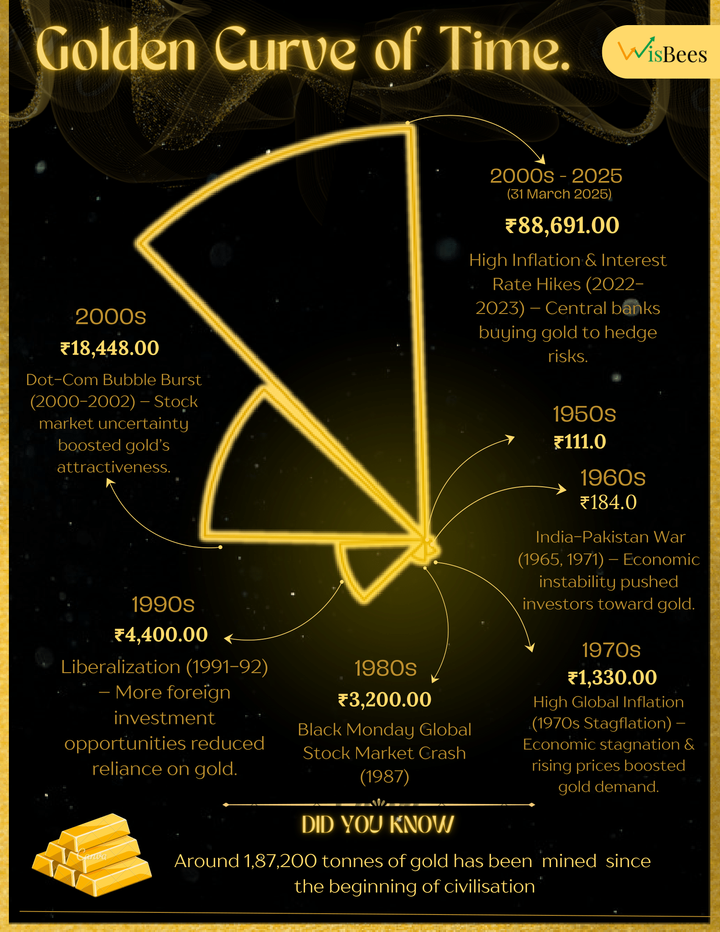

Our needs begin to outweigh our wants, and we find ourselves trapped in a vicious cycle—earning just to pay off monthly EMIs and student loans. To make matters worse, inflation continuously erodes whatever meager savings we manage to accumulate. Faced with these financial hurdles, the next obvious question arises: How do we grow our money? Or, as financial influencers like to say, "Let your money work for you."

When we think about wealth growth, the stock market is the first thing that comes to mind. After all, we are familiar with market legends like Warren Buffett, Rakesh Jhunjhunwala, and many more, and we, too, have dreamt of building wealth through investments. Investing or trading in equities seems like an attractive option, especially when the market is performing well. But what if it doesn’t?

The Reality of Retail Investing

The Indian stock market has witnessed a significant increase in retail participation post-COVID. In response, regulators have tightened the rules to protect small investors—and rightly so. Studies show that retail traders are more likely to lose money than gain, and only a small percentage succeed in the long run. Unlike institutional investors, most retail traders do not have the expertise or access to the same level of information.

As the saying goes, "Everybody is a genius in a bull market." But when the bulls retreat and the bears take over, can retail investors still outperform the index? Probably not.

The Concept of Mutual Funds

Now, imagine having a dedicated portfolio manager who could guarantee a specific annual return while managing risk—a full-time professional whose only job is to optimize your portfolio. Of course, no single individual can afford such a service. Otherwise, we wouldn’t need to invest in the first place. However, what if a group of investors pooled their money to hire a professional to manage their funds collectively?

This is precisely how mutual funds work. By pooling money together, investors reduce their individual costs while benefiting from lower risk and a more diversified portfolio.

Mutual Funds: India’s Wealth-Building Tool

Mutual funds in India date back to 1963, when the Unit Trust of India (UTI) was introduced by the Reserve Bank of India (RBI). The private sector entered the space in 1993, and today, India has 44 different asset management companies (AMCs), each led by some of the best minds in finance. These managers have dedicated research teams that analyze the market in ways that an average retail investor simply cannot.

With just a few clicks, retail investors can now access funds tailored to their specific financial goals. Mutual funds allow investments across various asset classes, including equities, debt, commodities, and real estate, while avoiding the pitfalls of direct investing.

Key Benefits of Mutual Funds

1. Liquidity

Imagine you own a flat that you occasionally rent out. One day, you need cash urgently. How do you liquidate your property without selling it entirely? Real estate lacks liquidity—you cannot sell a portion of your flat. However, if you had invested in mutual funds instead, you could withdraw only the amount you needed, with the money reflected in your bank account within 1 to 5 business days.

2. Higher Returns

It is common knowledge that mutual funds provide better after-tax returns than many traditional investments. Let’s compare:

- Fixed Deposits (FDs): Barely beat inflation, and interest income is taxed at 10% TDS (if interest exceeds ₹40,000) and per tax slab.

- Mutual Funds: Long-term capital gains (LTCG) tax is 12.5%, while short-term capital gains (STCG) tax is 20%. Additionally, the first ₹1.25 lakh in LTCG is tax-exempt.

Thus, mutual funds offer superior tax efficiency and long-term wealth growth.

3. Diversification

Mutual funds provide diversification across and within asset classes. Investors can choose from various schemes, including:

- Equity Funds – Large-cap, mid-cap, small-cap, sectoral, and ELSS (tax-saving funds).

- Debt Funds – Liquid funds, corporate bonds, and government securities.

- Hybrid Funds – A mix of equity and debt for balanced risk-reward.

Even within a single equity fund, fund managers typically invest in 50-70 stocks, reducing portfolio risk. Not all stocks perform poorly at the same time, ensuring a more stable investment.

4. Low Transaction & Maintenance Costs

Let’s revisit our real estate example. What costs do you incur when owning property?

- Stamp duty & brokerage fees

- Annual property tax

- Maintenance & renovation costs

- Capital gains tax on selling

Additionally, there’s no guarantee of timely rental income or selling the property at fair market value. Mutual funds, on the other hand, have negligible transaction and maintenance costs—you can buy or sell with just a few clicks.

5. Easy Comparisons

Unlike real estate or insurance, mutual funds offer standardized disclosures, making it easy to compare funds based on:

- Returns

- Risk levels

- Expense ratios

- Fund manager performance

The Rise of Mutual Funds in India

Due to these advantages, mutual funds have gained popularity among Indian households, especially among the youth. This surge in participation has led SEBI to tighten regulations, making the industry highly transparent and nearly fraud-proof.

Over the years, various campaigns have promoted mutual funds, with “Mutual Funds Sahi Hai” being the most notable. Time and again, mutual funds have proven this statement true—they are designed to empower the common investor.

However, it is important to note that mutual funds are not a get-rich-quick scheme. Investments require time to grow, yet the average holding period for mutual fund investments in India is just 2.4 years. This is often due to poor fund selection or lack of proper financial planning.

Final Thoughts: Making the Right Investment Choices

While investors can buy mutual funds directly from fund houses, it is often advisable to consult a mutual fund broker who can tailor an investment strategy based on individual goals. Investing is a lifelong process, and no investment should be made in isolation. Every financial decision should align with the bigger picture of wealth creation.

Mutual funds offer liquidity, diversification, tax benefits, and professional management—all while ensuring your money works for you. The sooner you start, the better your financial future will be.