The Timeless Value of Gold

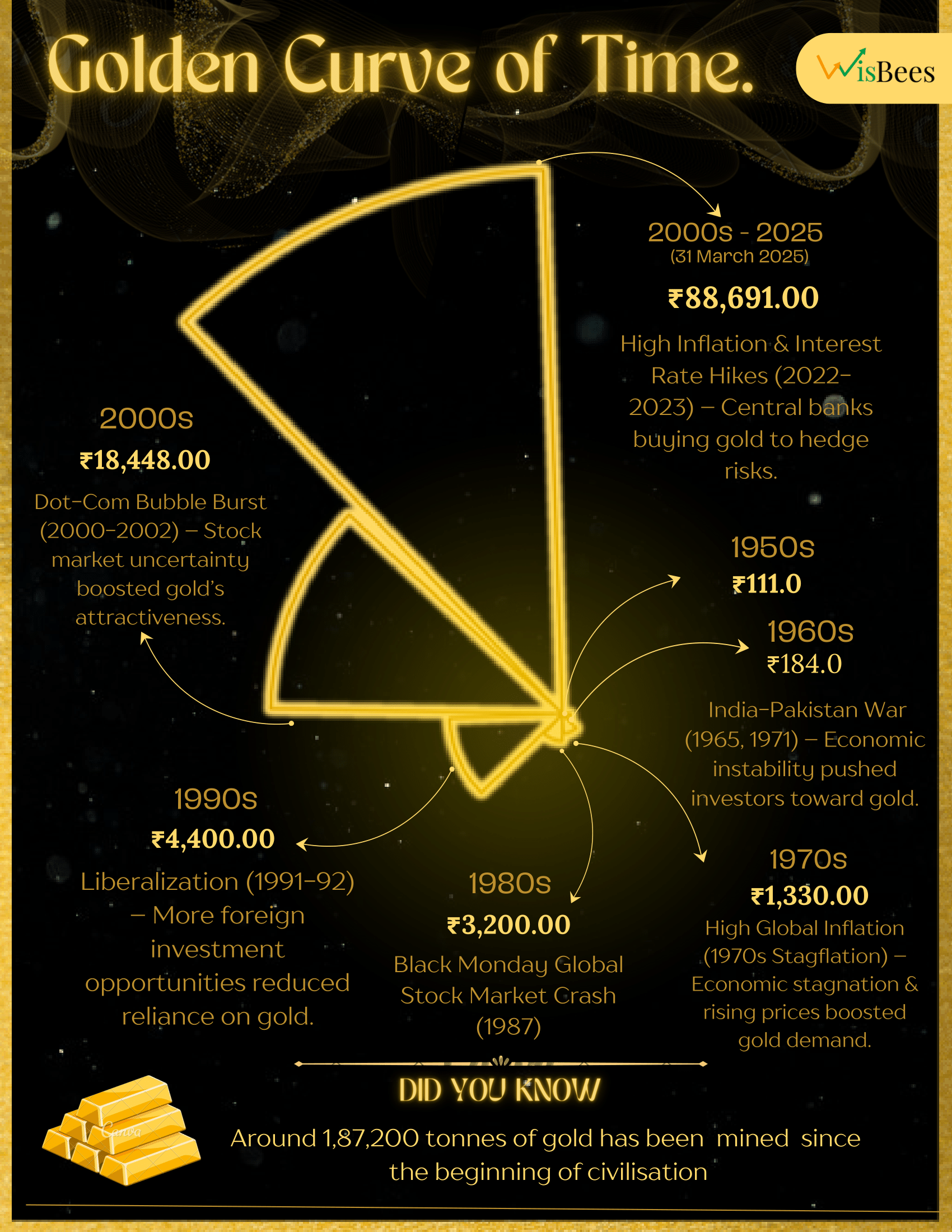

Golden Journey: A Timeline of 24K Gold Prices (1950s–2025)

This timeline tracks the evolution of 24K gold prices per 10g from the 1950s to 2025, influenced by major global and domestic events.

- 1940s: World War II boosted global demand for gold; India’s Independence created economic uncertainty, increasing gold’s appeal.

- 1950s: Bretton Woods system and gold import restrictions ensured price stability — the lowest decade-wise return.

- 1960s: Indo-Pak wars and Rupee devaluation raised economic fears, pushing investors towards gold.

- 1970s: Collapse of the gold standard, stagflation, and oil crises led to a massive gold boom — the highest return (+623.9%).

- 1980s: Inflation stabilized, leading to a price correction. Black Monday caused short-term volatility.

- 1990s: Economic crisis and liberalization reduced dependence on gold. Gold leasing increased supply.

- 2000s: Dot-com bust, Gold ETFs, and the 2008 crisis revived gold’s safe-haven status.

- 2010s: Eurozone crisis, Middle East tensions, and RBI’s gold monetization scheme sustained demand.

- 2020s (till 2025): COVID-19, Russia-Ukraine war, and inflation led central banks to boost reserves — pushing gold to all-time highs.

Across decades, gold has consistently acted as a reliable hedge against uncertainty, proving itself as a timeless store of value.