Smart Money Moves: Short-Term Financial Planning for Tough Times

In today's rapidly evolving economic landscape, financial uncertainty has become a major concern for many individuals. A recent survey by Aditya Birla Sun Life Insurance, the A-Nishchit Index 2024, revealed that 88% of Indians anticipate heightened financial instability over the next five years. This prevailing sentiment underscores the critical need for effective short-term financial planning to navigate unpredictable times.

Understanding Financial Uncertainty

Life’s unpredictability—whether a sudden job loss, a health crisis, or an economic downturn—can leave even the savviest planners feeling overwhelmed. It could lead to irregular income, unexpected expenses or some external shocks. Financial uncertainty encompasses various factors that can disrupt personal financial stability, including:

- Economic Fluctuations: Market volatility, inflation, and recession can impact income and savings.

- Employment Instability: Job loss or reduced income due to economic downturns or industry changes.

- Health Emergencies: Unexpected medical expenses arising from illnesses or accidents.

- Technological Advancements: Rapid technological changes, such as the rise of artificial intelligence, may render certain job skills obsolete. Notably, 33.95% of survey respondents on Business Standard expressed concern over the impact of technological advancements on their careers.

Short-Term Financial Planning

Short-term financial planning focuses on managing finances over a period ranging from a few months to a couple of years. It involves setting immediate financial goals, budgeting, saving, and investing wisely to ensure liquidity and financial security. While we can’t control the future, we can prepare for it. Short-term financial planning under uncertainty is about building resilience, staying flexible, and making smart choices today to protect yourself tomorrow. Given the current climate of uncertainty, such planning is essential to mitigate risks and maintain financial well-being.

Key Strategies for Effective Short-Term Financial Planning

Step 1: Assess Your Current Financial Health

Before planning, you need to understand and know where you stand:

• Track income and expenses: Use free apps like Money Manager or a notebook to log every dollar for a month.

• List debts: Credit cards, loans, or medical bills. Highlight high-interest debts first.

• Identify essentials: Housing, utilities, groceries, healthcare.

Example: If your income drops by 20%, which expenses can you trim immediately?

Step 2: Build a Mini Emergency Fund (Fast!)

Even a small buffer can prevent debt spirals.

• Start with Rs. 500/1000: Skip takeout, sell unused items, or take a weekend gig.

• Grow to 1 month’s essentials: Aim for rent, utilities, and groceries.

• Keep it separate: Use a digital savings account to resist temptation.

Why it matters: A simple Rs. 500/1000 fund can cover a flat tire, a broken phone, or a week of groceries during a crisis.

An emergency fund acts as a financial buffer against unforeseen expenses. Financial experts recommend saving at least 3 to 6 months' worth of living expenses in a liquid and easily accessible account. According to the A-Nishchit Index 2024, 69.28% of individuals have dedicated savings accounts for emergencies, whereas 30.72% do not have any emergency savings.

Step 3: Adopt a “Rolling Budget”

Traditional budgets fail when life changes daily. Adopt a Flexible and Realistic Budget. Try a weekly rolling budget:

• Weekly income check: Did you earn more or less than expected? Adjust immediately.

• Essentials-only mode: If income dips, prioritize:

1. Housing (rent/mortgage).

2. Utilities (electricity, water).

3. Food (stick to basics like rice, beans, veggies).

• Pause nonessentials: Postpone subscriptions, hobbies, or dining out.

Pro tip: New age Budget Apps can auto-categorize spending, making adjustments easier.

Creating a budget that accounts for both fixed and variable expenses is crucial. Given the potential for unexpected costs, it's advisable to allocate a portion of income to discretionary spending, which can be adjusted as needed. Regularly reviewing and adjusting the budget ensures alignment with current financial circumstances.

Step 4: Create Backup Income Streams

Don’t rely on one source. Thinking of exploring additional income avenues, such as freelance work, part-time jobs, or passive income through investments, can enhance financial stability.

Relying solely on a single income source can be risky in uncertain times. Diversification not only supplements income but also provides a safety net against potential job loss.

Example: A teacher tutors online evenings, earning an extra Rs. 10,000 a month.

Step 5: Tackle High-Interest Debt Aggressively

Debt grows faster under stress. Focus on:

• Credit cards: Pay minimums on all but the highest-interest card (throw extra cash there).

• Payday loans: Avoid these traps—seek nonprofit credit counseling instead.

• Consolidation: Combine debts into one lower-interest loan (e.g., Upstart or credit unions).

Rule of thumb: If interest is above 10%, prioritize repayment.

High-interest debts can significantly strain finances, especially during economic downturns. Prioritizing the repayment of such debts reduces financial burden and improves creditworthiness. Strategies like debt consolidation or negotiating lower interest rates can also be beneficial.

Step 6: Invest in Insurance Coverage

Insurance policies serve as protective measures against unforeseen events. The A-Nishchit Index 2024 indicates that 76.57% of individuals have taken insurance policies as financial safeguards. Ensuring adequate health, life, and property insurance coverage can prevent substantial financial setbacks during emergencies.

Step 7: Negotiate, Negotiate, Negotiate

When cash is tight, ask for flexibility:

• Landlords or lenders: Request deferred payments or reduced rates.

• Utility companies: Many offer hardship programs.

• Medical bills: Hospitals often provide discounts or payment plans.

Key phrase: “I’m facing a temporary challenge. Can we work out a plan?”

Step 8: Slash Costs Creatively

Cut expenses without sacrificing well-being:

• Food: Buy generic brands, use coupons, or join a community garden.

• Transportation: Carpool, bike, or use public transit.

• Healthcare: Opt for telehealth visits or generic medications.

Bonus: Libraries offer free Wi-Fi, books, and streaming services—cancel paid subscriptions!

Step 9: Leverage Community, government, and Tech Resources

You’re not alone:

• Government programs: Check eligibility for unemployment, or utility assistance.

• Apps: A few new apps provide donations and assistance in case of needs relating to health emergencies, and community services.

• Food banks and pantries: Locate a few subsidized or free food services near you in case of financial crunch

Step 10: Stay Informed and Adaptable

Keeping abreast of economic trends, policy changes, and market conditions enables proactive financial decision-making. An adaptable financial plan that can be modified in response to changing circumstances is more resilient against uncertainties.

Seek Professional Financial Advice

Above all Consulting with financial advisors can provide you with personalized strategies tailored to individual financial situations. Despite the importance of financial planning, 34.87% of respondents admitted to not engaging in financial planning or review, relying solely on professional guidance. Professional advice can bridge this gap and offer informed perspectives on managing finances effectively.

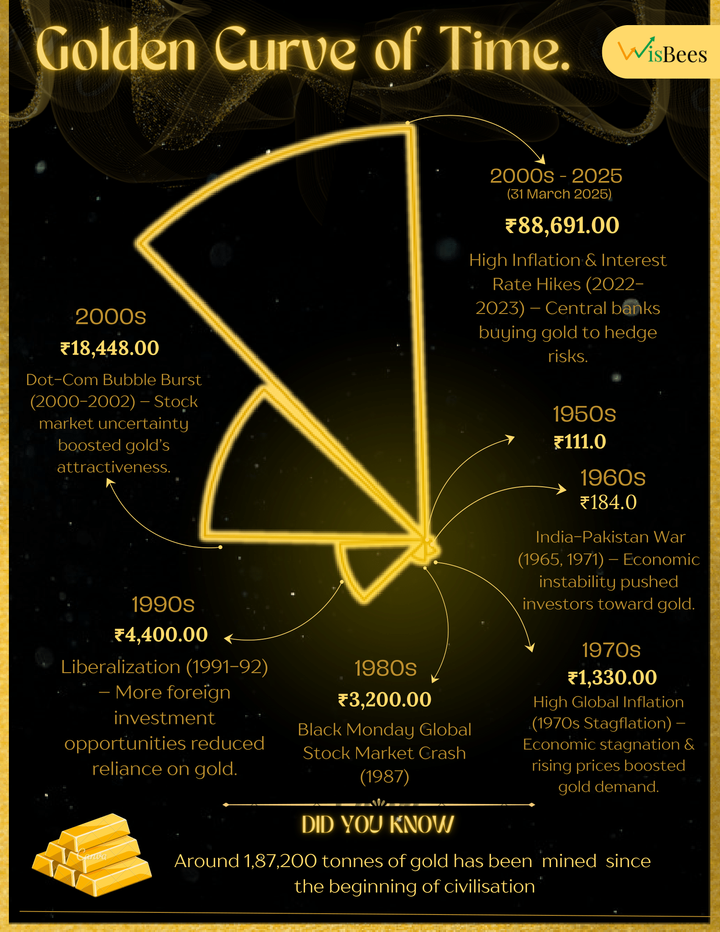

The Role of Traditional Investment Avenues

In times of uncertainty, individuals often gravitate towards traditional investment options perceived as safe. The survey revealed that 77% of respondents on the Business Today Survey prefer stable investments such as bank fixed deposits, prioritizing security over high returns. Additionally, 72% diversify their portfolios by including traditional assets like gold and real estate, maintaining confidence in these well-established investment avenues.

Final Word: Embrace the “Good Enough” Plan

Perfection isn’t possible in uncertain times. Focus on what you can control:

• Save something, even Rs. 500. That’s a win!

• Cut one unnecessary expense.

• Reach out for help when needed.

Financial resilience isn’t about avoiding storms—it’s about learning to dance in the rain. Start today, step by step, and you’ll build a safety net that lets you face the unknown with confidence.

“It’s not how much you have, but how resourceful you are with what you have.”