"Mankind Pharma IPO: The Buzzing Initial Public Offering of 2023"

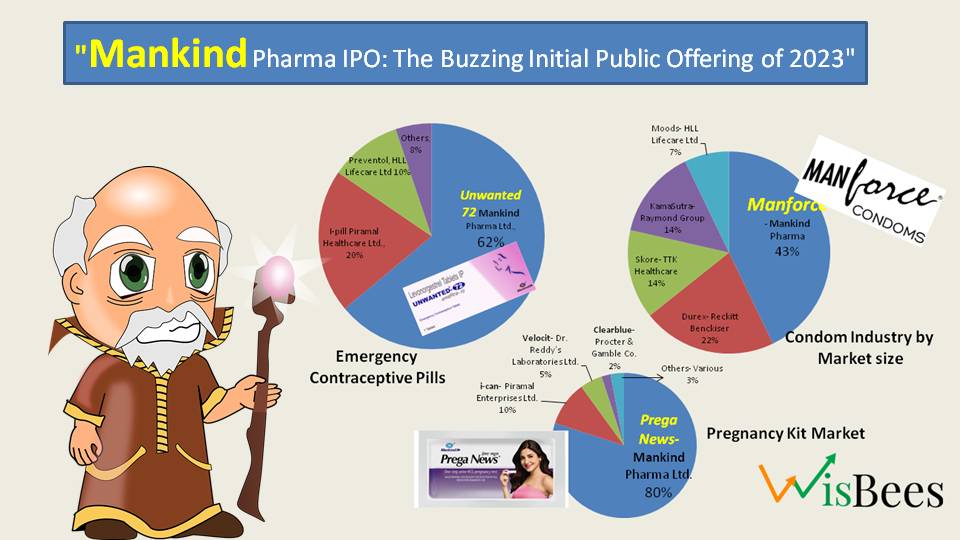

Have you ever wondered, the popular brands like "Unwanted 72", "Man Force Condoms", and "Prega News" belongs to which company? And how much market share of these products have in their respective domain? Yes we are talking about, none other than the Mankind Pharma IPO, set to be the biggest IPO of the year in terms of issue size.

Before we dive deep into the company's business model and financials, let me present you with a graphic that illustrates the market shares of these products in their respective categories.

IPO issue period: April 25-27, 2023

Price band: ₹1026-1080 per share

Minimum bid quantity: 13 shares and multiples thereof

Number of shares: 40,058,844

Issue size: ₹4,326 crore

Face value: ₹1 per share

Type: Offer for Sale (existing shares being diluted by existing shareholders)

No fresh issue of shares

Fundraising: ₹4,110 crore (lower band) to ₹4,326.35 crore (higher band)

Lot size: 13 shares

Minimum investment: ₹14,040 for 1 lot, Maximum investment: ₹1,96,560 for 14 lots

50% of the offer reserved for Qualified Institutional Buyers (QIB), 15% for High Net Worth Individuals (HNI), and 35% for Retail Investors

Date of allotment: May 3, 2023

Initiation of refund: May 4, 2023

The credit of shares into Demat account: May 8, 2023

Date of listing: May 9, 2023

Mandate end date: May 12, 2023

Anchor investors lock-in end date: May 27, 2023

Grey market premium: 7%

About The Company

Last few days, there is a buzz in the pharmaceutical world about the most awaited Initial Public Offering (IPO) of the year.All eyes were on Mankind Pharmaceuticals, a company that had been making waves in the industry with its impressive growth and innovation.

Mankind Pharmaceuticals proudly claimed to be India's fourth largest pharmaceutical company in terms of domestic sales and the third largest in terms of sales volume for Moving Annual Total (MAT) December 2022.

The company had been focusing on developing and manufacturing acute and chronic therapeutic areas, outpacing its peers with a growth rate of 14%, which was 40% higher than its competitors. In addition to its pharmaceutical products, Mankind Pharmaceuticals also had a range of consumer healthcare products in its portfolio.

What made Mankind Pharmaceuticals stand out was its unwavering focus on the Indian market, with over 97% of its total revenue coming from operations within the country. This was one of the highest revenue contributions from India among its peers, showcasing the company's strong presence in the domestic market.

Mankind Pharma has achieved the distinction of being the youngest company to rank among the top five pharmaceutical companies in India, in terms of domestic sales. This remarkable feat can be attributed to the company's impressive credentials, including a portfolio of over 36 esteemed brands, a significant domestic sales figure of over 500 million Indian rupees, one of the largest distribution networks of medical representatives, the trust of over 80% of doctors in India who prescribe its products, a team of 600+ scientists, and four dedicated units of R&D department located at IMT Gurugram, Haryana, and Thane, Maharastaraha.

They have a pan India presence with a field force of 11691 medical representatives and 3561 field managers as of December 31st, 2022 holding 1st position by prescription. 25 manufacturing facilities across India which include a formulation manufacturing capacity of 42.05 billion units per annum.

Between FY20-FY22 its market share has grown from 4.1% - 4.3% beating its top 10 competitors and domestic sales grew at a CAGR of approx. 12% outperforming the overall IPM growth in domestic sales of approx. 10% by 1.3 times.

The company on 29th July filed one investigational new drug application for a new chemical entity (NCE) anti-diabetic molecule, which is in its phase I clinical trials, and two NCE molecules for autoimmune diseases and non-alcoholic steatohepatitis which are currently in the pre-clinical stage. This means they are constantly and aggressively into R&D to launch new and innovative products.

About The Industry

Rising income levels, increasing life expectancy, and the growing burden of lifestyle diseases, along with government initiatives such as significant budget allocations for research and healthcare (Rs. 3,201 crores (US$ 419.2 million) for research and Rs. 83,000 crores (US$ 10.86 billion) for the Ministry of Health and Family Welfare), have contributed to the growth of the Indian pharmaceutical market. The market has witnessed a Compound Annual Growth Rate (CAGR) of 10.5% from FY12 to FY22 and is projected to triple in size in the next decade.

In 2021, India's domestic pharmaceutical market was valued at US$ 42 billion, and it is expected to reach US$ 65 billion by 2024, with further expansion to US$ 120-130 billion by 2030. The consumer healthcare segment is anticipated to grow at a rate of 10-11%. Moreover, India is a major player in the global pharmaceutical industry, with drugs being exported to over 200 countries worldwide, and the United States serving as a key market. Generic drugs from India account for 20% of the global export in terms of volume, making the country the largest provider of generic medicines globally. In FY22, Indian drug and pharmaceutical exports reached US$ 24.60 billion, following US$ 24.44 billion in FY21.

Products and Market shares

Mankind Pharma's product portfolio includes several highly popular products that have emerged as leaders in the market with significant market shares. Manforce, with domestic sales amounting to approximately 4616 million Indian rupees, holds a market share of 29.6%. Unwanted-72, with domestic sales of 1083 million Indian rupees, captures a substantial market share of 61.7%. Prega News, with domestic sales totaling approximately 1844 million Indian rupees, commands a significant market share of 79.7%. Gasofast, with domestic sales reaching 1230 million Indian rupees, has a notable market share of 4.4%.

The following table sets forth the details relating to the Domestic Sales, growth rate, market share and ranking of our highest selling pharmaceutical brands:

They hold the top three positions in almost all of their product by market share as of MAT ranking in December 2022.

Competition

Mankind Pharma faces competition from top domestic players including Alkem Laboratories, Cipla, and Lupin. It also competes with multinational companies like Pfizer, Novartis, and AstraZeneca in India's pharmaceutical industry.

Risks Related to Business

- Dependence on manufacturing and transportation: Any disturbance or slowdown in manufacturing or research and development could affect the business since they rely heavily on manufacturing and transportation.

- Supply chain risks: The company's supply of raw materials or finished formulations comes from third-party suppliers and manufacturers, which exposes them to supply chain risks. This includes 790 suppliers amounting to Rs. 20,222.75 million (93.08%) from domestic suppliers, 35 suppliers amounting to Rs. 1,074.62 million (4.95%) from China, and 45 suppliers amounting to Rs. 429.07 million (1.97%) for the FY 22.

- Dependence on third-party manufacturers: The company relies on third-party manufacturers to produce key products, which generate significant revenue. Any issues with these third-party manufacturers could affect the company's revenue.

- Market risks: The company's major market is India, with 96.79% of the total revenue from operations. Any changes in the Indian market or other major countries, such as the USA, Bangladesh, Sri Lanka, and Nepal, could affect the company's revenue.

- Competition: The company faces competition from both domestic and multinational companies, which could affect its market share and revenue.

- Seasonal fluctuations: The demand for and sales of the company's pharmaceutical and consumer healthcare products may experience seasonal fluctuations, with higher sales during the first half of the year as compared to the second half.

- Insurance coverage: The company's assets may be insufficiently insured, which could result in losses if any unforeseen events occur.

- Export promotion capital goods scheme: If the company fails to export goods worth a defined amount within a certain period of time, they will be penalized with a sum equivalent to the duty enjoyed under the scheme, along with interest.

- Related-party transactions: The company has entered into related-party transactions, which could be perceived as a conflict of interest and may affect the company's reputation.

FINANCIALS from DRHP

- Profit after tax (“PAT”) margin for the period/year

- Return on Equity (ROE)

In conclusion, the Mankind Pharma IPO is set to be the biggest IPO of the year in terms of issue size. With a strong focus on the Indian market and impressive growth rates, Mankind Pharma has established itself as a leading pharmaceutical company in India. The Indian pharmaceutical market is projected to triple in size in the next decade, providing ample opportunities for growth in the industry. Overall, the Mankind Pharma IPO presents an opportunity for investors to tap into the growth potential of the Indian pharmaceutical market.

| Broker | Type | Offerings | Invest |

|---|---|---|---|

|

Discount Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |

|

Discount Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |

|

Discount Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |

|

Service Broker | Mutual Funds, Stocks, IPOs, Bonds | Know more |